We have talked about the power of househacking multiple times on the podcasts and why it may make sense for someone looking to get started in investing (and make sure to check out the Househacking Calculator under our Resources Tab). If you’re just getting up to speed, house hacking is a strategy that entails renting out some or all of your primary residence to generate rental income that can be used to offset the mortgage and other expenses associated with home ownership. I have personally done this strategy and I would like to highlight the key items you need to know from a tax perspective when it comes to househacking. This article will help you better understand the tax benefits of real estate and how these benefits apply specific to house hackers.

Determining Basis

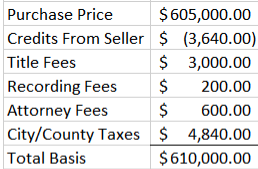

Per the IRS, basis is the amount of your capital investment in your property for tax purposes. This will come into play when you claim depreciation for your property (discussed in a section to follow). The majority of the below items that go into basis will be found on your closing statement. Items that go into this include, but are not limited to:

Purchase price

Credits from the seller

Title Fees

Recording Fees

Attorney fees

City/county specific taxes

Any other costs needed to purchase the property (i.e. scoping of sewer lines, paying an electrician to inspect the property)

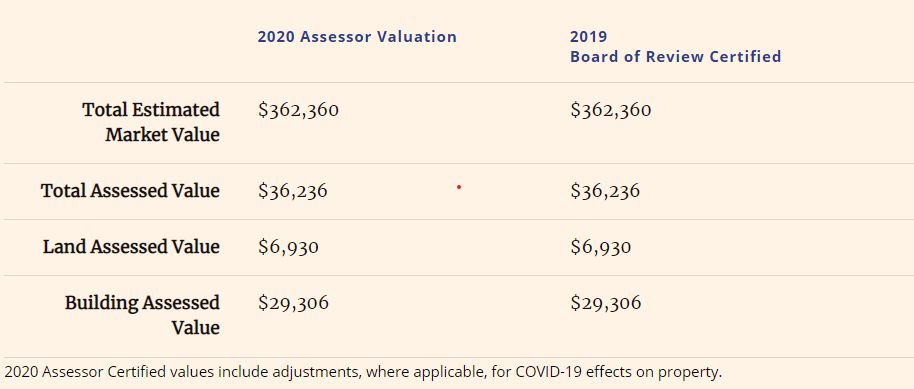

Once you determine your basis, you will allocate the basis between building and land. The most common way to allocate between building and land is to look on your local county assessor’s website. For an example in Cook County, see below. You will find the total assessed value, land assessed value, and building assessed value. You will take the building’s assessed value and divide it by the total assessed value to come up with the percentage of the value that should be allocated to the building. You will do the same step for land. The building portion is depreciable whereas land is not. They will list out the building and land values.

Example

The below was used to calculate the basis of the property.

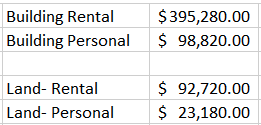

The next step is allocating between building and land by going to the assessor’s website.. Using the above, 81% of the basis will be for the building ($6,930/$36,236) and the remaining 19% will be allocated to land. Therefore, $494,100 will be allocated to building and $115,900 will be allocated to land.

Allocating Between Rental and Personal

The next step is to determine the portion of the building and land that is for rental use versus personal use. The reason why we are doing this is because we are an owner occupant and therefore can not take 100% of the depreciation.

The two common ways to allocate between rental and personal use are by bedrooms or square feet. If there is an appraisal, the square footage of each unit will be listed. If there is no appraisal, you will need to measure yourself or find an alternative method. A best practice would be calculating both to see which method is most advantageous. You will also want to document the approach you used and use numbers to back up your decision in case your tax return is audited. This calculation will also be used for determining how expenses are allocated between rental and personal uses.

Example

The property used above is a four unit property. Let’s assume that there are ten total bedrooms, of which two rooms are in the unit you will be living in. You would be able to get 80% allocated for rental. The other option is to go by square feet. Let’s say that after measuring, each unit is 1,000 square feet and therefore the house is 4,000 square feet total. Therefore, the rental section is 75%. As such, we will elect to take the most advantageous method. In this case, that would be the 80%.

Now, we can piece this together to formulate the amount that we can depreciate on our return. The building percentage that will be allocated to our rental will be $494,100 multiplied by 80% which totals $395,280. The land that will be allocated to our rental will be $115,900 multiplied by 80%. The amounts below that are “personal” will not be included on our return. What happens to that will be discussed in the next section.

Depreciation

Depreciation is one of the biggest benefits of real estate. It is a “paper” expense. The government is saying that since you bought this property, you are able to deduct some of the costs related to the building over what the IRS deems to be its useful life (27.5 years). This depreciation allows you to shield your income that you make from the property. For the house hack, you will be able to claim depreciation on the amount that is related to the rental during the time that you live there (see above for how to allocate between rental and personal). After moving out and advertising the unit you will be able to depreciate your unit too, which means you will be able to claim more depreciation. If it weren’t for this benefit, many real estate investors would be paying a lot more in tax.

Example

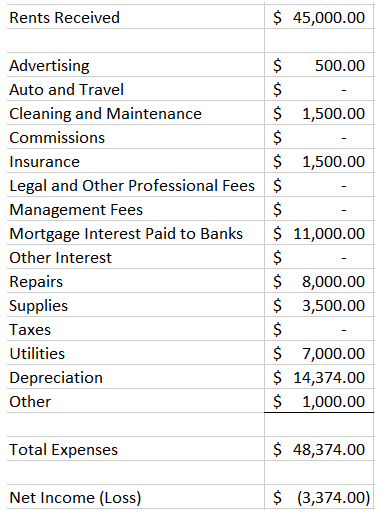

The amount of depreciation on an annual basis would be the “building rental” listed above divided by 27.5 years. As such, you will get $14,374 ($395,280/ 27.5 years) in yearly depreciation from your rental during the time that you live in the property using the above numbers. When you move out and advertise the unit, you will get additional depreciation on the personal unit you are now renting out.

Calculating Expenses

At the end of the year, you’ll want to make sure you’ve gathered all your receipts and adequately categorized your expenses so you can take as many deductions as legally allowed. The biggest thing to be aware of is allocating the expenses properly between personal and rental uses as well as among units. A few examples:

Example 1: Throughout the year, there are various repairs and maintenance issues that come up in unit #2 of your rental (note: this is not the unit you’re occupying). Assuming these relate 100% to unit #2, these expenses should be allocated 100% to your rental for unit #2.

Example 2: During the year, you will pay your water bill. GIven that this is a utility that’s used by every unit, you would allocate based on the percentage that you have prescribed (i.e. bedrooms or square feet). You would not be able to expense the portion that allocates to your unit.

Property Taxes

This section primarily applies to the first year of purchase. In some areas of the United States, counties assess taxes in arrears (i.e. paying 2019 taxes in 2020). If this is the case, you will receive a property tax credit on your closing statement. If you receive a property tax credit in excess of the amount you have to pay for that year, you will not be able to claim a tax deduction for property taxes. However, if your property tax credit is less than the amount that you pay, you will be able to claim the excess. This is best explained through the below examples:

Example 1:

In May 2019, you purchase your first house hack and receive a property tax credit for $6,500. The amount that was paid by you in 2019 was $6,300. In this instance, you will not be able to deduct the $6,300 paid and you will need to credit the excess of $200 forward to the following year’s tax return to be taken as a credit.

Now, let’s say in 2020, you pay $8,000 in taxes. You would be able to deduct $7,800 (8,000-200).

Example 2:

In February 2020, you purchase your first house hack and receive a property tax credit for $4,000. The amount that was paid during 2020 was $5,600. In this instance, you would be able to deduct $1,600 on your 2020 return.

Determining Your Tax Impact

Using some of the numbers from the above, mainly depreciation, I have created the below example. Please note that rents received is a positive number and expenses are being subtracted from rents received to get to a net loss of $3,374. This means that after all income and expenses, your expenses are higher than your income. Ordinarily, you would not be able to deduct this loss as this is considered passive income for the purposes of the IRS. However, there is a provision within the tax code that allows small landlords to deduct up to $25,000 against ordinary income (i.e. W-2 income). You have to meet three conditions. First, you have to make below $150,000 in adjusted gross income (AGI). Second, you have to be a non-real estate professional who owns at least a 10% interest in the property. Third, you must actively manage the subject property.

For the income limitation, you have to be at $150,000 in adjusted gross income or less to qualify for the deduction. Here is how it works. If you make less than $100,000, you can claim up to $25,000 in losses. If you make above $100,000, the loss is phased out at $2 for every $1. What this means is that if you make $125,000, you can claim up to $12,500 in rental losses. If you make over $150,000 in adjusted gross income, you cannot qualify for this deduction.

For the 10% interest in the property, this means that you own more than 10% of the property. For example, if you are using FHA financing, put down the minimum down payment of 3.5%, and have no partners, you would still qualify because you are entitled to 100% of the benefits.

For active participation, this means that you are meaningfully involved in making management decisions. Such decisions would include: approving tenants and selecting contractors or vendors. There are certainly more decisions that the landlord makes but these are two common examples.

Assuming you have met the qualifying criteria of this carve out, you would be able to deduct $3,374 against your active income. This could save you significant money depending on what tax bracket you’re in..

Wrapping It All Up

With house hacking, there are additional tax considerations and there are many important steps that must be taken to get an accurate assessment of your potential tax impact. If you are planning on doing this yourself, the above should be helpful. If you are outsourcing to a CPA, you will want to make sure that they calculate the basis correctly and that they understand the living arrangement so expenses can be allocated appropriately.

If you have questions on your real estate tax strategy, you can reach me (Aaron Zimmerman) at aaronz@thethinkers.com.

Additional Resources: