In the tax world, I’ve already noted that there’s been quite a few changes in recent years. One change that I haven’t talked about until now is the qualified business income deduction (QBID). This came out as part of the latest tax cuts effective for tax years starting in 2018. In this article, we will discuss what this deduction is, who this deduction applies to (and doesn’t), and why Congress enforces this deduction. We will also discuss the limitations of QBID, calculating QBID, and what forms your accountant will need to file to ensure you get the deduction. We will be going through simple scenarios to illustrate the key points. You will want to discuss with your accountant to see if you qualify in your specific situation. Let's dive in.

Definitions

Qualified Business Income (QBI) - Per the IRS, this is the net amount of qualified items of income, gain, deduction and loss from any qualified trade or business. Items that are excluded are capital gains, certain dividends, and interest income. There are some other items that are excluded. See question #4 on this link for additional details.

Qualified Business Income Deduction - A free 20% deduction off qualified income (income from business or dividends from REITS)

Unadjusted basis - You have to use the asset in your business, must be used to generate QBI, and the period over which an asset is depreciable but must not end before the end of the tax year. Assuming these facts are true, the unadjusted basis is the original cost of the asset.

Who This Deduction Applies To (And Doesn’t)

This deduction applies to sole proprietors, LLCs, and S Corporations. If your business is structured as such whether it’s fix and flip, brokerage, property management, etc, it does not matter. You may be entitled to this deduction. To be entitled to this deduction, you must have positive taxable income. If there are losses, these will roll forward to future years (thus offsetting income).

For real estate, the only two excluded property types are house hackers (those that live in one unit/bedroom and rent out the others) and triple net leased properties.

Why Congress Made This Deduction

As part of the latest round of tax cuts, Congress lowered the tax rates of C Corporations to 21%. To make the playing field more level for the owners of passthrough entities (with income that would be taxed at up to 37%), they opted to make a 20% deduction to make the tax regime more competitive.

Limitations

The amount that can be claimed for a maximum deduction is the greater of 50% of wages OR 25% of wages plus 2.5% of unadjusted basis. Further, there’s an income limitation that may apply to certain businesses, but this mostly does not apply to real estate. To illustrate the concept, let’s go through two examples:

Example 1: Real estate Investor With No W-2 Wages

A real estate investor purchases one building during the year for $800,000, of which $700,000 is allocated to building (after looking at the county assessor’s website). The investor does not have any W-2 wages. As such, it is most advantageous to use 25% of W-2 wages (in this instance zero) plus 2.5% of unadjusted basis. The unadjusted basis is the value of the portion allocated for building ($700,000). As such, the maximum QBID that this investor could claim for this property is $17,500.

Example 2: Property Management company with W-2 employees

A property management company structured as an S Corporation has a growing business and they have expanded their employee base in recent years. As such, the company has W-2 wages of $1,000,000 and minimal hard assets (i.e. machinery and equipment). The maximum QBI deduction would be 50% of W-2 wages. In this case, it would be $500,000 ($1,000,000 * 50%). Since this is an S Corporation, this would be split amongst its owners.

Calculating QBID

Generally speaking, you will calculate your QBI as the profit from your business less the relevant exclusions (outlined above in the “Definitions” section). For a real estate investor that has properties on Schedule E, the amount of QBI would be equal to the profit (after depreciation). For other businesses, you may need to back out S-Corp owners wages or guaranteed payments made to partners. That is why you need a good accountant who knows the ins and outs of this deduction. To illustrate this, we go through a few examples:

Example 1: Real Estate investor with one property

Let’s assume the maximum amount that QBID could be is $17,500 (as noted above in example 1). Now, let’s assume the property, after all income and expenses (including depreciation) was $8,000. This investor would be eligible to receive a deduction of $1,600 ($8,000 * 20%). In effect, the investor would be paying tax on $6,400 ($8,000 - $1,600) of income instead of $8,000.

Example 2: Real estate investor with three properties

Let’s assume the maximum amount of QBID is still $17,500. However, we add two additional properties. Let’s assume the first property nets $10,000, the second property loses $5,000, and the third property nets $15,000. The amount of QBI is the sum of all of these $20,000. The investor would get a $4,000 ($20,000 * 20%) deduction. Instead of paying tax on $20,000, you would pay tax on $16,000 ($20,000 - $4,000).

Example 3: Property Management Company with two owners

A highly profitable property management company earned $1,000,000 (after all applicable exclusions). Assuming the same facts as example #2 from the previous section, the maximum deduction would be $500,000. The deduction in this instance would be $200,000. Assuming there are two owners and it’s split 50/50, each owner would be receiving a $100,000 deduction. Instead of each owner paying taxes on $500,000 ($1,000,000 * 50%), they would be paying taxes on $400,000 of income ($500,000 - $100,000).

Correct Form To Use

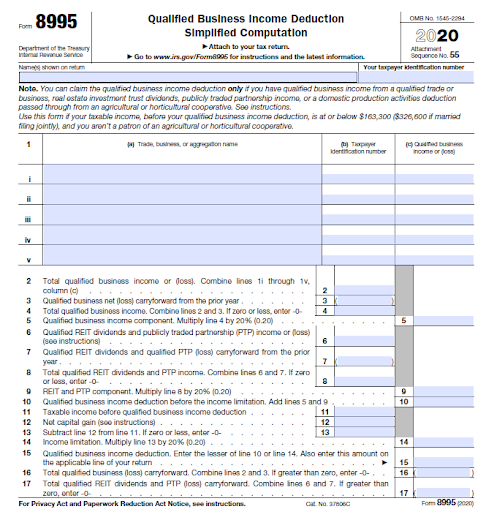

You will use form 8995 or 8995-A to report the QBI or loss. This will go along with your individual tax return (form 1040). Below is what the form 8995 looks like.

Other Items To Reiterate

To obtain this deduction, you must have positive QBI. Should you have a loss, this will be netted against future QBI. If you have persistent losses from your real estate related businesses, you will not be able to take advantage of this deduction, as you will have no income.This should all be maintained by your accountant (and their software).

The other way to obtain this deduction is through investing in real estate investment trusts (REITs). The dividends from this are eligible for the QBID as well. Generally, you will see these appear on your 1099-DIV statement for your brokerage account.

Wrapping It Up

This deduction has a lot of intricacies that were not discussed in this article to avoid confusion. I wanted to distill the key points for you to understand. After this article, my hope is that you will have an understanding of what this deduction is, who this applies to, and what to look for to tell if your accountant has filed the form showing the amount of the deduction. You will want to discuss with your accountant about your specific situation and businesses you run to see what will qualify, what will not, and if you can ultimately benefit. I have seen instances where individuals have lost out on significant opportunities by not being aware of this deduction. Do not let that be you.

If you have questions on your real estate tax strategy, you can reach me (Aaron Zimmerman) at aaronz@thethinkers.com.

Looking for a Property Manager? Schedule a call today or visit our website for more information.

Get your FREE copy of: Top 10 Mistakes Investors Make When Working With Lenders

Extra Hacks & Tricks from Expert Investors? Join Our Facebook Group!

Missed something? Subscribe to our Youtube Channel!

LISTEN to our Podcast on iTunes | Spotify | Stitcher | TuneIn Radio

Need A Responsive Property Manager? We’ve got you covered!