While it is increasingly more popular to become an entrepreneur, there also needs to be some consideration for setting yourself up for future growth. In traditional W-2 jobs, there are 401(k)’s that function as excellent retirement vehicles with some restrictions. When you’re an entrepreneur, you are now solely responsible for your retirement accounts. In this article, I will explain the solo 401(k) and why it can be lucrative for the self-employed.

Solo 401(k) Explained

Solo 401(k)’s are retirement plans specifically for self-employed individuals or businesses with no full time employees. The main exception is that both you and your spouse can be paid from the business and still maintain a solo 401(k). The solo 401(k) is your personal retirement account for your business.

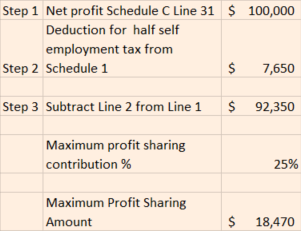

The bigest thing to be aware of is that if you are an employee (i.e. W-2) and self-employed, you are limited to contributing $19,500 (for 2020) on the employee side. However, on the employer side, you have much more flexibility. You can make an employer contribution of up to 25% of your net self employment income (net profit less half self employment tax and plan contributions you made for yourself). An example of this will be listed below. The amount of combined contributions is subject to compensation limits per the IRS listed here.

Solo 401(k) Eligibility

It does sound pretty great to be able to contribute more money as the employer and save on taxes. However, there are some qualifications as well. They are:

No Full Time (Qualifying) Employees

This is not to say that you can’t have any workers in your business. You just can’t have a qualifying employee should you want to set up a solo 401(k). A qualifying employee (as a general rule) is one that works over 1,000 hours per year or long-term, part time employees that have worked in the business for 500 hours per year for three consecutive years.

Intent to Generate Income and be Ongoing

Your business must be able to generate income consistently. It can’t be a one off side job that generates income in one year. While it does not necessarily need to generate income every year, you should plan to generate income most years. One of the primary benefits of having a solo 401(k) is predicated on your ability to produce income (which can then be used to fund an employer contribution and therefore reduce taxes owed).

Must Have Self Employment Income

This income can come from a variety of sources whether it be a partnership, LLC or sole proprietorship. Unfortunately, real estate income does not count as this is considered passive income.

Solo 401(k) Pros and Cons

As with any decision, the pros and cons must be weighed carefully to determine what is most beneficial for you. Here are a few for each:

Pros

Assuming the business is profitable, you would have the opportunity to contribute to the plan as the employer (therefore saving you money on taxes).

The contribution limits are higher. For instance, as an employee for 2021, you can contribute $19,500. The employer can also contribute an additional amount as an employer contribution assuming there is income.

You can have the account be traditional or roth. Traditional contributions get a tax deduction in the year of the contributions whereas the roth contributions are paid with after-tax dollars. Traditional contributions are taxed upon withdrawal whereas roth contributions are not.

It is fairly easy to administer. There are no filing requirements unless assets exceed $250,000 or if distributions are taken from the plan.

Cons

You must make contributions on a somewhat frequent basis (the IRS refers to this as “recurring and substantial” or risk getting the solo 401(k) plan shut down. The IRS has defined this as making contributions in at least three of the past five years. Therefore, you must have the cash to fund the plan should your business be operating at a loss.

You will need to obtain a separate federal identification number for your solo 401(k) which takes some time to obtain.

There may be additional costs to run the plan which may eat away at some of the tax savings.

Example

An individual decides to work as a part time realtor while maintaining a full time position as a W-2 employee at their company. The first year, they make $3,000 after all expenses. The second year, they make $30,000 after all expenses. At this point, this individual does not know about the solo 401(k) yet. After doing some light reading in year three, they decide that they should open up a solo 401(k). They open it up during the year and are curious about the potential tax savings. After all is said and done, the net profit for the business is $100,000. After going through the mechanics of the form, $92,350 is their income for determining the contributions. Given that 25% is the maximum allowable contribution, they determine $18,470 is the maximum contribution. With being a diligent saver, they’ve kept this money set aside to deploy in a tax-deferred way. At a 24% marginal tax rate, this saves $4,433 in tax today. Another option would be to put the $18,470 in a Roth account for their solo 401(k). The money would be tax free coming out. Either way, this individual puts themselves in a significantly better financial position by putting away money for retirement.

Other Accounts To Consider Opening

There are two other retirement accounts you may find useful in opening as a small employer: A SEP IRA or a Simple IRA. I have included some links below that may be helpful in your search to determine what is best for your needs. In my opinion, these vehicles offer less flexibility for the average Schedule C employee with no employees. However, should there be additional hires to your company, you would want to explore these retirement vehicles.

Conclusion

Assuming you meet the qualifications for a solo 401(k), it can be a valuable tool to put away money for retirement as a self-employed person especially if you are making significant dollars. Not only can it save money on taxes, but it also sets yourself up with a better financial position. However, you may not want to tie up monies in a 401(k) as that capital could be used for real estate. Ultimately, it is up to you to determine what is best suited for your financial situation.

If you have questions on your real estate tax strategy, you can reach me (Aaron Zimmerman) at aaronz@thethinkers.com.

Resources:

Deduction Worksheet for Contributions (see page 22)