What is Debt Service Coverage Ratio (DSCR) and as a Chicago real estate investor why should you care? DSCR is a measurement of your property’s net cash flow compared to your debt obligation. To calculate your DSCR you take your annual net operating income (NOI) and divide by your total annual debt payments. So a DSCR of 1.00 means that your income is exactly covering your monthly obligations. This is obviously not ideal as you want to be making money each month and also be able to stomach any unforeseen or one-off expenses.

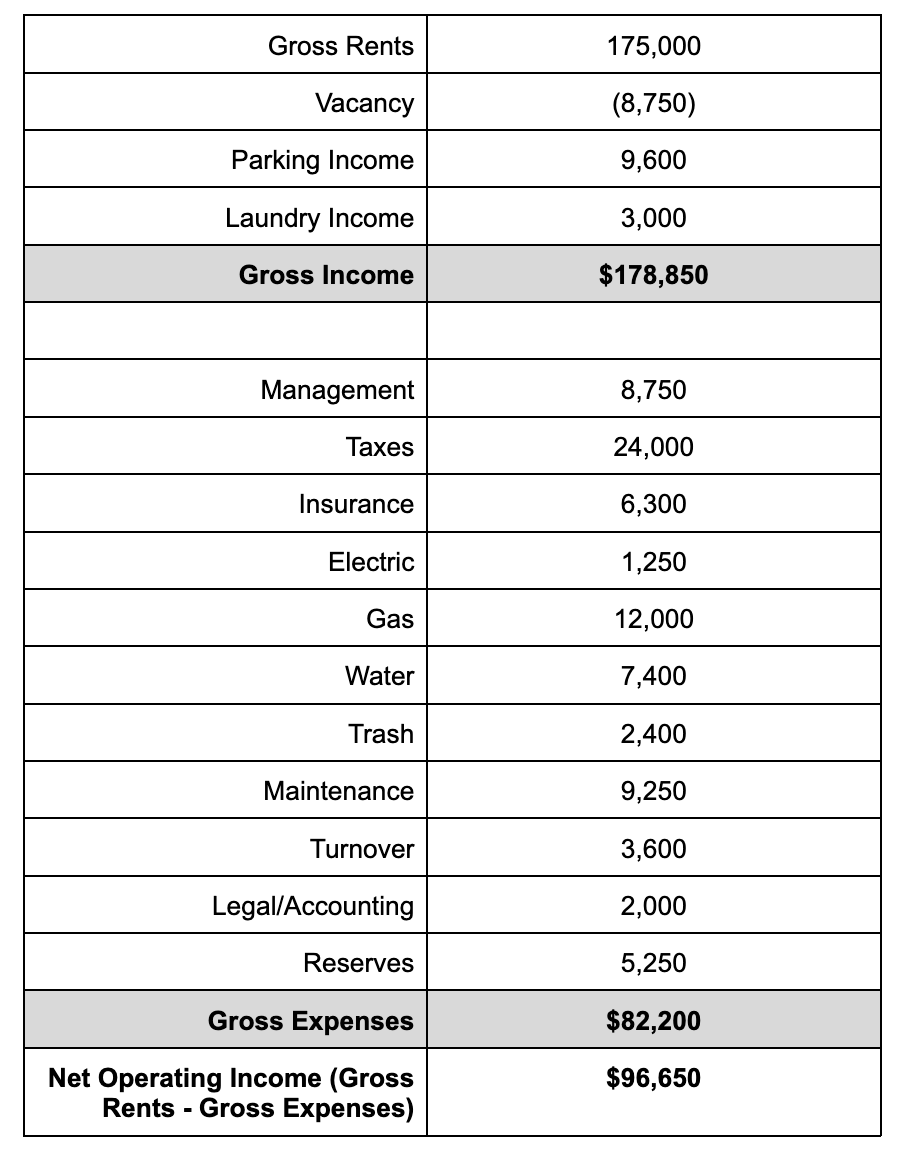

For simplicity sake let’s look at the following example (note this is just an example, you may have other expenses like landscaping, pest control…etc):

NOI in the above example is $96,650. If the mortgage payment on this building is $6,250/month, then your annual debt expense is $75,000 ($6,250*12). The DSCR formula is NOI/annual debt expense so your DSCR is calculated as $96,650/$75,000, equating to a DSCR as 1.287. What does this 1.287 actually mean?

For starters it shows the property is cash flow positive as the DSCR is greater than 1.00. Is 1.287 “good?” That answer depends on many factors, but as a general rule of thumb, many lenders will look for the DSCR to be 1.2-1.25. This is traditionally considered a good enough net positive position where the borrower would still be able to meet their debt obligations even if there was unforeseen expenses or vacancy that altered the gross income or expenses.

What if the current DSCR is below 1.25? Well it means the cash flow is extremely tight and you could be setting yourself up for failure. Or, maybe you are buying a building with rents well under market, or a building with a 15% vacancy rate; thus the gross rental income is low but there is an immediate upside. In these situations certain lenders may work with you but they will take into consideration your track record, liquidity/reserves, and your path to getting the DSCR to a more acceptable number as quickly as possible. They may also lower your loan-to-value to lower your mortgage obligation and increase the DSCR (by decreasing the annual debt obligation).

Regardless of what your lender is willing to do, you need to ensure that you can handle the current cash flow situation and not purely rely on future or pro forma rents.

Tom Shallcros is a Chicago investor, developer, licensed IL real estate broker with Second City Real Estate, and co-host of the Straight Up Chicago Investor Podcast - www.straightupchicagoinvestor.com

Looking for a Property Manager? Schedule a call today or visit our website for more information.

Get your FREE copy of: Top 10 Mistakes Investors Make When Working With Lenders

Extra Hacks & Tricks from Expert Investors? Join Our Facebook Group!

Missed something? Subscribe to our Youtube Channel!

LISTEN to our Podcast on iTunes | Spotify | Stitcher | TuneIn Radio

Need A Responsive Property Manager? We’ve got you covered!

.jpg)