In past articles, I’ve shown you how to calculate your basis in your property. I’ve also shown you how to allocate the purchase price of your property between building and land. In this article, I’ll go through seven ways to do so. As a reminder, the reason why this is so important is because the initial basis will tell you the amount of depreciation you can claim on your tax return. This will allow you to plan better for your taxes.

For each of these methods, it is important to know that whichever method you choose, it is based on someone’s best estimate. These could still be challenged in court for accuracy but these are the reasonable methods that have worked in previous cases. For each of the below, we will look through these through the buyer’s point of view.

Key Terms

Section 1245 Property - This is for personal property. Examples include carpeting, cabinetry, window treatments, appliances, etc.

1. Buyer and Seller Mutually Agree To Written Purchase Price Allocation

This method is the most interesting. Here’s why: the buyers and sellers are a bit at odds with each other. The buyer generally wants a higher allocation to building so they can depreciate more. The seller wants less allocated to building so they may potentially recapture less (and pay less tax). Provided that there are adverse tax interests, then this method is allowed. How you would do this is to add this to your purchase agreement. In the agreement, you would state the value of land, building, land improvements, and section 1245 property.

Remember, land improvements (15 year useful life) and section 1245 property (generally 5 or 7 year useful life) is eligible for bonus depreciation. That means, you can take 100% of the cost that’s allocated to this in year one. This could produce a significant tax advantage for the buyer because there could be significant depreciation deduction. For the seller, this could result in fewer gains (thus saving them in tax) for the land improvement portion. However, with land improvements, you do not want to have an aggressive allocation (10-15% maximum of the purchase price).

Example:

A buyer and seller come to an agreement and for a purchase price of $500,000. The sale closes on 7/1/21. Of the $500,000, $100,000 is allocated to land and the remaining $400,000 is allocated to building (includes building, land improvements, and section 1245 property). Of the $400,000, $50,000 is land improvements, $20,000 is section 1245 property, and the remaining $330,000 is allocated to building.

In total, the amount of year one depreciation that could be taken is:

$50,000 Land Improvements

20,000 Section 1245 property

6,000 Depreciation of remaining $330,000 divided by 27.5 for half the year

________________________________________

76,000 Total year one depreciation

It is important to note that you don’t necessarily need to accelerate the depreciation if you don’t want to either. The above would simply represent the best case scenario after describing the facts above.

2. Replacement Cost of Building = FMV

To do this, you would need to figure out the best way to estimate the replacement cost of the building. This acceptable method came from this court case memo. In short, you would need someone to provide an estimate for the replacement cost of the building (i.e. how much it would cost per square foot of the building). The excess between the costs to rebuild and the purchase price would be the portion allocated to land.

Example:

An investor purchases a building that is 4,000 square feet for $700,000. After talking with a couple qualified individuals and obtaining estimates for replacement costs of the building, it is determined that the cost to replace would be $150 per square foot to rebuild the property.

Building cost = $150 per square foot * 4,000 = $600,000

This $600,000 now represents the cost of the building. The portion allocated to land is determined to be $100,000 ($700,000 - 600,000).

3. Reproduction Cost Less Refurbishment Cost

In this instance, the fair market value of an older building is equal to the reproduction cost less the cost to refurbish.

Example:

An investor purchases a building that is 4,000 square feet for $700,000. After talking with a couple qualified individuals and obtaining estimates for replacement costs of the building, it is determined that the cost to replace would be $150 per square foot to rebuild the property. The building cost would be $600,000 ($150 * 4,000) less the cost to refurbish ($50,000).

The portion allocated to building would therefore be $550,000 and the remaining $150,000 would be allocated to land.

4. Reproduction Cost Multiplied by Percentage

This method is essentially the same as #3 except instead of backing out the cost of refurbishment, you’re just taking an estimated percentage.

Example:

Using the same facts as above, the unadjusted cost of the building is $600,000. You would then apply a percentage, in this case 90%. As such, the cost of the building is $540,000 ($600,000 * 90%). The remaining $160,000 ($700,000 - 540,000) would be allocated to land.

5. Appraiser’s Letter

This is one of the better methods if you can do it. The IRS seems to favor this method above many of the others. Within the appraisal, there is typically a section that distinguishes between building and land. If there is not one filled out from the appraiser, see if they can send something that’s revised that has this information in the report.

Example:

An investor purchases a building that is 4,000 square feet for $700,000.Within the appraisal, there is information that contains the value of the land and the value of the building. The value of the land was determined to be $200,000 and the building was determined to be $500,000.

6. Assessed Value

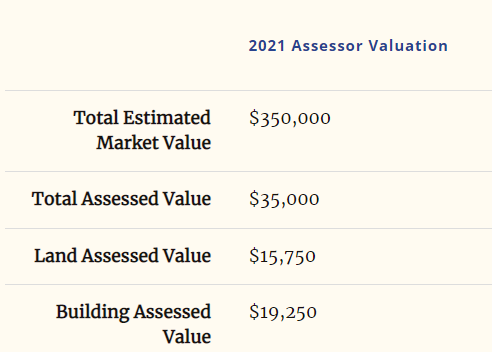

If there’s no better evidence, use this. The IRS does not seem to like this as much as the county’s can adjust the assessed values as they see fit. What you would do is go to the county assessor website and allocate the percentages of building and land to your property.

Example:

An investor purchases a building that is 4,000 square feet for $700,000. Based on the county assessor’s website, you would allocate 45% to land (15,750/35,000) and 55% to building (19,250/35,000).

As such, the amount allocated to building would be $385,000 and the amount allocated to land would be $315,000.

7. Average of (1) CPA’s estimate (purchase price - land = building) and (2) Assessed value

This method would entail for the investor to go to their CPA and request an estimate of FMV. It is not necessarily the best method as the CPA is not necessarily the most knowledgeable about properties and their values (even if they’re a real estate CPA!). Nonetheless, we’ll go through an example.

Example:

Let’s assume the same facts as above. After some analysis, the CPA determined that 80% should be allocated to building and 20% should be allocated to land.

% allocated to building: (55% (from above) + 80%)/2 = 67.5%

% allocated to land: (45% (from above) + 20%)/2 = 32.5%

As such, the amount allocated to building would be $472,500 (67.5% * 700,000). The amount allocated to land would be $227,500 (32.5% * 700,000).

Putting It All Together

All of the above methods are an estimate. It is up to you and your CPA to determine what the most appropriate information is based on the information you have available. Methods 1-4 would take a bit more effort to complete but there could be some benefit such as you may be allowed to take more depreciation. Ultimately, it is up to the investor to gather the information and the CPA to provide some guidance in planning discussions before purchasing a property (assuming the investor has these types of calls with their CPA).

If you have questions on your real estate tax strategy, you can reach me (Aaron Zimmerman) at aaronz@thethinkers.com.

Looking for a Property Manager? Schedule a call today or visit our website for more information.

Get your FREE copy of: Top 10 Mistakes Investors Make When Working With Lenders

Extra Hacks & Tricks from Expert Investors? Join Our Facebook Group!

Missed something? Subscribe to our Youtube Channel!

LISTEN to our Podcast on iTunes | Spotify | Stitcher | TuneIn Radio

Need A Responsive Property Manager? We’ve got you covered!